Cambodia Weekly Financial News

Cambodia Weekly Financial News

2024-08-23View Times| 1105

Cambodia Weekly Financial News

August 16 ~ 22 , 2024

16 August 2024

Cambodia Collects $43.6 Million in E-commerce Tax Over Seven Months

Cambodia’s General Department of Taxation (GDT) earned $43.6 million in e-commerce value-added tax (VAT) income during the first seven months of 2024, the department announced on Thursday. In July alone, the GDT collected $6 million in tax revenue from this sector. The GDT, a government agency responsible for collecting various taxes, including income tax, salary tax, VAT, and property tax, reported a total of $1.91 billion in tax revenue during the January-July period this year, achieving 46 percent of the target for 2024.

新闻来源 : Khmer Times

17 August 2024

Cambodian Banking and Financial Associations

implement new rules to strengthen operations and consumer protection

The Association of Banks in Cambodia (ABC) and the Cambodia Microfinance Association (CMA) introduced new regulations to enhance responsible business practices and protect consumers in the banking and financial sectors. The rules focus on ethical lending, particularly by prohibiting the use of certain state-owned or communally owned lands as collateral and banning the use of personal identification documents, like national IDs and passports, as loan security. Additionally, the regulations require lenders to thoroughly assess borrowers' repayment capacities, especially for vulnerable groups, to prevent over-indebtedness. The sector, which includes 59 commercial banks and 87 microfinance institutions, has loans totaling $58.9 billion and deposits of $51.9 billion as of June 2024.

新闻来源 : Khmer Times

18 August 2024

PAS generates over $52 million in revenue in H1 2024

Sihanoukville Autonomous Port (PAS), Cambodia’s largest port, reported a 25% revenue increase in the first half of 2024, reaching approximately $52 million—$10 million more than the same period in 2023. The port's total assets grew by 5.29% to $420 million, with total equity rising by 5.69% to over $250 million. Analysts attribute this growth to Cambodia’s steady economic performance, driven by tourism and garment manufacturing, and the recent completion of a new container terminal, which has boosted the port's capacity and attracted more business. PAS remains Cambodia's sole international and commercial deep seaport.

新闻来源 : Khmer Times

19 August 2024

Wing Bank Sign MOU with SERC For Investor ID Online Payment

Wing Bank Plc signed a MoU with the Securities and Exchange Regulator of Cambodia on the “Usage of Electronic Payment Services for Payment on Online Investor Identification Number (ID) Applications and Renewals” on August 19, 2024. Through this agreement, investors can make an online payment for investor ID applications and renewables directly to the SERC via Wing Bank mobile. H.E Sou Socheat said this collaboration aims to facilitate service payments for investor ID applications for those in Cambodia and from overseas, so they can more easily participate in Cambodia’s securities market. He added that this utilized technology to make the investor's ID application faster and safer and to improve reliability.

新闻来源 : B2B Cambodia

20 August 2024

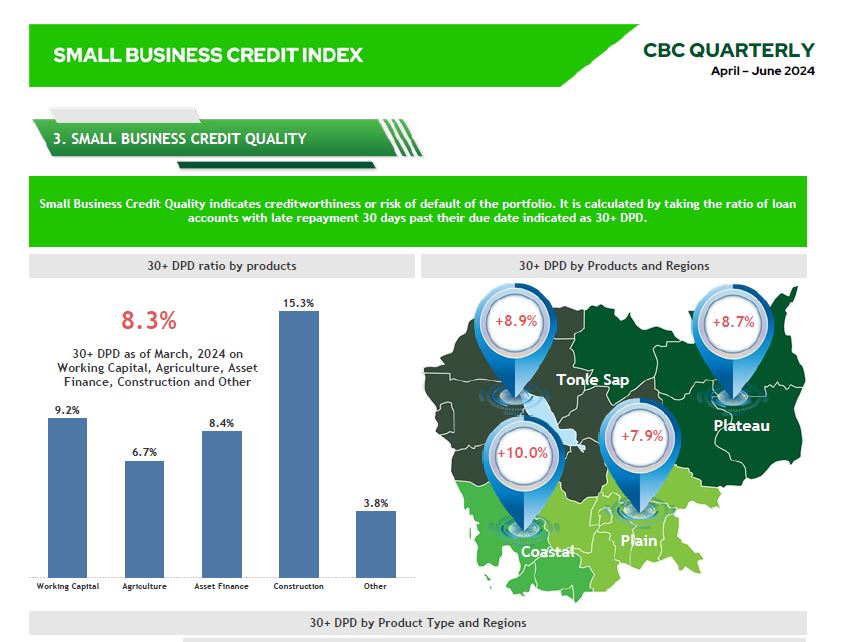

CBC Reports Small Business Loans

Hit $34B+ for Q2 2024, 30+DPD Ratio Increases to 8.3%

The Credit Bureau Cambodia (CBC) has released its small business credit index report for the second quarter of 2024, revealing a complex landscape of mixed performance across various credit metrics. While the overall number of loan accounts saw a decline. The total number of small business loan accounts decreased by 1.7$ bringing the total to approximately 1.86 million accounts by the end of the quarter. Despite this contraction in loan accounts, the outstanding balance for small business loans recorded a slight increase of 0.1% reaching $34.22 billion. This indicated that while fewer businesses are taking on new loans, the size of the existing loans has grown.

新闻来源: Cambodia Investment Review

21 August 2024

National Bank of Cambodia and Bangko Sentral ng Philipinas

Sign MoU to Increase Financial Cooperation

The National Bank of Cambodia and Bangko Sentral ng Pilipinas signed an MoU on 19 August 2024 to improve the cooperation between the two Southeast Asian central banks with a focus on digital financial innovation, cross-border payment systems, and cybersecurity. The NBC stated online, “ The MoU provides a clear framework for the facilitation of bilateral ties and the enhancement of collaboration between the two central banks particularly in the areas of central banking, payment connectivity and innovation, digital financial innovation, banking supervision, human resource development and other areas of mutual interest”. The report suggested the meeting discussed macroeconomic trends and advancements in payment systems, artificial intelligence, cybersecurity, and sustainable finance.

新闻来源: B2B Cambodia

21 August 2024

Cambodia Launches Tourist App Enabling Payments with KHQR

The National Bank of Cambodia Launched the “ Baking Tourists App” helping foreign tourists in Cambodia to make payments using the country’s universal KHQR code at over 3.3 million retail merchant outlets. The Bakong Tourists App will promote tourism in Cambodia by providing international tourists with an electronic means of payment for goods and services efficiently and conveniently. This will not only give international tourists a new experience with digital cash in Cambodia, but it will also address some of the challenges in the tourism sector. Thourn Sinan, Chairman of Pacific Asia Travel Association Cambodia noted that “ By integrating KHQR for payments, it not only streamlines transactions but also promotes the use of local digital currency. This innovation can make it easier for visitors to explore and enjoy the beautiful offerings of our country while supporting local businesses. Overall, it’s an exciting development for tourism in Cambodia.”

新闻来源: Khmer Times

22 August 2024

Bank Credit growth slows, but deposits up 13% to $52B

Cambodia’s banking system continues to be resilient in both capital and liquidity, although credit quality and profitability have declined, said the National Bank of Cambodia (NBC). Loans have increased 2.6 percent to 238.1 trillion riel ($59 billion), while deposits have increased 13.4 percent to 209.9 trillion riels ($51.9 billion) for H1 2024. The banking industry seems to be headed for further slowdown in 2024, unless the demand for loans picks up in the latter half of the year. The NBC attributed the slow credit growth to weak recovery in some sectors of the economy. “Credit quality and profitability have declined as fund costs have risen and credit growth has slowed due to the weak recovery of some sectors of the economy combined with prudent lending of banking and financial institutions.”

新闻来源: Khmer Times

Lady Aegies观点: To be continue...............